Setting Up Your Own Exchange via Yellow – The Rise of Retail Brokers

Skyinclude has started as a Handshake blog and video channel to help “get you included in the sky” of web3 and dweb. Over the years we have worked with so many amazing projects and developers in the decentralized community - and one of the biggest struggles we see with Handshake?

Liquidity on the HNS coin.

We see in Twitter over and over again, how does someone new get HNS coin to buy names?

So today, you know life works in amazing ways - we at SkyInclude are starting as an ambassador for a project that just may be able to solve Handshake’s coin liquidity problem.

The project is called “Yellow” - and it took me a bit of time to wrap my head around it so hope today’s video can help you get the gist as well.

Imagine A World Where Everyone Can Be a Broker or Exchange (Like installing Wordpress)

This website is built on WordPress. We install the framework on a server of our choice, configure the database, and “boom” we have a website.

This is how I see the YELLOW project, except instead of a blog / CMS, it is an exchange framework.

With their Yellow Network’s Openware OpenDax v4 solution (coming soon), you can download it, and install on any server and domain. The goal is to allow each of these new “retail brokers” to be similar to a “node” on a network -

“Centralized” or “decentralized”

So imagine using Akash AKT hosting, with HNS domains. Total decentralized exchange.

Yellow is On Ethereum - But Trades Happen “Off-Chain”

I talk to many in my network and first t hing they say is Yellow is an ERC-20 token and the gas fees are high. First, that will be solved - but this is the way I explain it.

You do not need YELLOW to do trades. Trades on these “local / retail broker” websites that are set up by you and me as “nodes” are trading on our own servers locally.

Kind of like a “decentralized network of centralized exchanges”. If that makes sense?

You need YELLOW to lock up as collateral to be a node (or have other token holders delegate to your node to meet the 250,000 YELLOW requirement to open a retail broker exchange). But you do not need YELLOW for the “B2C” trades on each transaction like in a DEX (decentralized exchange.

How does that work? The key is a “mesh network” via state channels

Study State Channels - and Let’s Unlock HNS Coin’s Liquidity

So the rabbit hole I am digging deeper into is the technology of state channels.

Some research of these brings us to:

https://www.cryptocompare.com/coins/guides/what-are-state-channels/

thanks to state channels, only the final outcome needs to be included in the form of one single transaction.

Other than keeping the information nodes need to store much smaller, state channels also provide additional advantages like private and instant transactions with lower fees.

Also an amazing blog post from Julie Plavik on the Yellow blog that goes into it:

https://medium.com/yellow-blog/a-complete-introduction-to-high-frequency-crypto-trading-cf36bd0c8720

A state channel comprises a set of open-source protocols, smart contracts, interfaces, and software that allow users to transact directly outside of the blockchain (i.e., off-chain) and minimize their on-chain operations only to the specific necessary sequences.

In particular, these on-chain activities are limited to opening up and closing a state channel between parties, and they validate only the final state between them after multiple transactions.

As state channels do not require node validation for every transaction, they can handle most user activities (trading, payments, etc.) with X-time more throughput and speed than Layer-1 protocols (blockchain layers). So such cutting the number of necessary on-chain iterations with the use of state channels reduces the costs and increases the speed of interactions drastically.

So essentially - it is for “onramp and offramp” in a “centralized” system. Meaning - if you want to trade on a “node” (retail broker) that has a certain preference to you (the coins they offer, the language, the UI, the community, the service, etc) - you deposit your coins to a smart contract.

Once that is “locked” - then you can trade on that local “CEX” (centralized exchange) and buy/sell all day long for as long as you want.

Once you are “done” - then you “close the state channel” and withdraw. So this is the second and final “on-chain” transaction. It will confirm the balance you have on this centralized exchange and then you unlock that from their smart contract and deposit to your wallet.

So basically, a “node” or a “retail broker” is a MEXC / Gate io centralized exchange, except using the technology and the liquidity and the “smart contract” protection system of Yellow.

Seems the key of this Yellow network is this state channel mesh network.

Let’s Unlock More Liquidity Together - for HNS and other coins / communities

For those in Handshake - we all know liquidity is an issue. I’d love to hear from the talented developers here ideas on how to use YELLOW and a local “retail broker” (node) someone here can setup (I will support - can make introductions, marketing, promotion) to add HNS as a state channel to their node on this YELLOW network to give the liquidity needed.

What do you say?

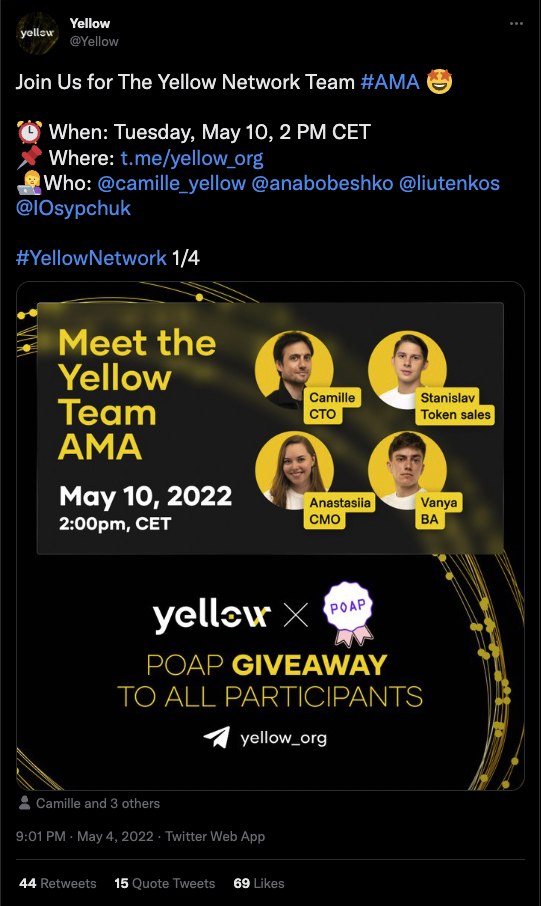

Join me as I host a Meet The Yellow Team AMA

Also I’m hosting an AMA (ask me anything) this Tuesday 2pm CET on the Yellow.org Telegram group - via audio.

Submit your questions and suggestions on their tweet below, join the group, and I look forward to seeing you there.

And join the official Telegram Network group at https://t.me/yellow_org

I’d Love Your Feedback and Input

The team here at SkyInclude will be diving deep down this Yellow “rabbit hole” as the launch of the YELLOW token is coming. If you have questions or ideas, we’d love to hear.

Check out the demo at https://alpha.yellow.org

Developers can check out the tech, OpenDAX v4 stack GitHub: https://github.com/openware/opendax

And the main site for setting up your own “node” exchange is https://yellow.org if you are doing this - I’d love to help and hear how it is going!